Project Introduction

Reserve aims to build a stable, decentralized, asset-backed cryptocurrency and a digital payment system that scales supply with demand and maintains 100% or more collateral backing. Ultimately, Reserve’s goal is to create a universal store of value – particularly in regions with unreliable banking infrastructure and regions where hyperinflation is an issue. The Reserve system will interact with three kinds of tokens: (1) The Reserve token (RSV), which is a stable cryptocurrency that can be held and spent the way we use normal fiat money; (2) The Reserve Rights token (RSR), a protocol token used to facilitate the stability of RSV – this is the token we will list through Huobi Prime; (3) A growing variety of tokenized real-world assets (such as other stablecoins) that are held by the Reserve smart contract to back RSV. The Reserve project is backed by people like PayPal co-founder Peter Thiel, YCombinator Chairman Sam Altman, and other influential Silicon Valley and crypto investors.

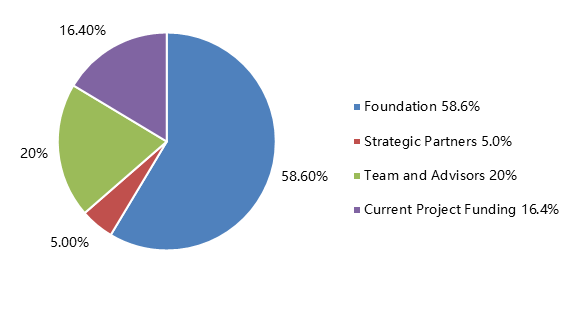

Reserve Rights Token Structure

Foundation:58.6%

Strategic Partners:5.0%

Team and Advisors:20.0%

Current Project Funding:16.4% (3% will be sold through Prime)

Reserve Rights Token Info and Release Schedule

Total Token Supply: 100,000,000,000 RSR

Prime Allocation: 3% of Total Token Supply

Prime Release Period: No lock-up/Vesting

Seed Round Price: $0.0004/RSR

Seed Round Allocation: 12,392,000,000, 12.39% of Total Token Supply

Seed Round Release Period: Vest over 6 months after main net launch, which is expected in 2020

Private Round Price: $0.0020/RSR (including bonus)

Private Round Allocation: 1,000,000,000 RSR, 1% of Total Token Supply

Private Round Release Period: Shortest release is 25% unlocked, 75% vest over three months, some tokens release more slowly

Team and Advisors Release Period: Vest over 6 months after main net launch, which is expected in 2020

Partners Release Period: Vest over 6 months after main net launch, which is expected in 2020

Foundation Release Period: 2.85% of total tokens are held by the foundation, unlocked. Unlocked tokens can be used at the team’s discretion for additional fundraising or other purposes. 55.75% of total tokens are held by the foundation with a specialized lockup, and are stored in a smart contract referred to as the "slow wallet." Slow wallet tokens are locked, and can only be withdrawn with four-week delay visible on-chain including message from the team explaining the withdrawal. This mechanism was designed by the Reserve team to give the project the ability to release tokens for fundraising and other purposes, while allowing the market to price in that information well before any newly released tokens can be sold by the project.

Note: It was previously stated that “slow wallet” withdrawals could be executed with a two week delay. The project chose to increase this to four weeks to allow for additional time for market participants to track project token movements. The contract address of the “slow wallet” is: https://etherscan.io/token/0x8762db106b2c2a0bccb3a80d1ed41273552616e8?a=0x4903dc97816f99410e8dfff51149fa4c3cdad1b8

Project Links

Website:https://reserve.org/

Whitepaper:https://reserve.org/whitepaper.pdf

Telegram discuss:https://t.me/reservecurrency

Telegram announce: https://t.me/ReserveAnnouncements

Twitter:https://twitter.com/reserveprotocol

Huobi Global

May 13, 2019

Comments

0 comments

Article is closed for comments.