Tiered adjustment factors function goes live officially after delivery and settlement at 18:00 on March 9,2020(GMT+8). For previous adjustment factor information, please click here>>>

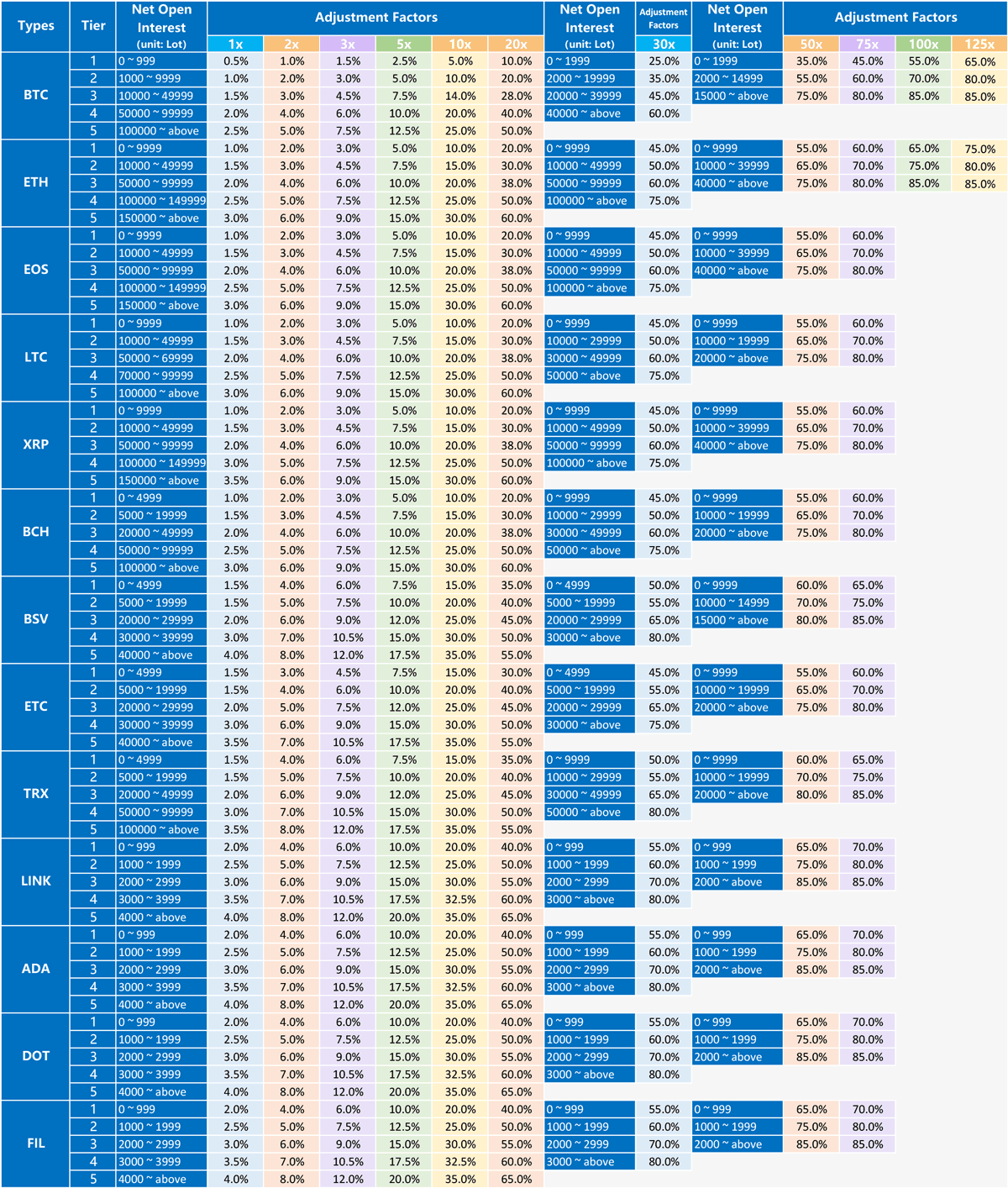

Adjustment factors is designed to prevent users from system's margin call losses. Huobi Futures adopts Tiered Adjustment Factors mechanism, in which there are five tier of adjustment factors. As users with higher net position, then he/she will be in higher tier of adjustment factor with higher risk.

Note: The face value of BTC contract is $100 USD/cont, other altcoin contract is $10 USD/cont. 【The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.】

【The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.】

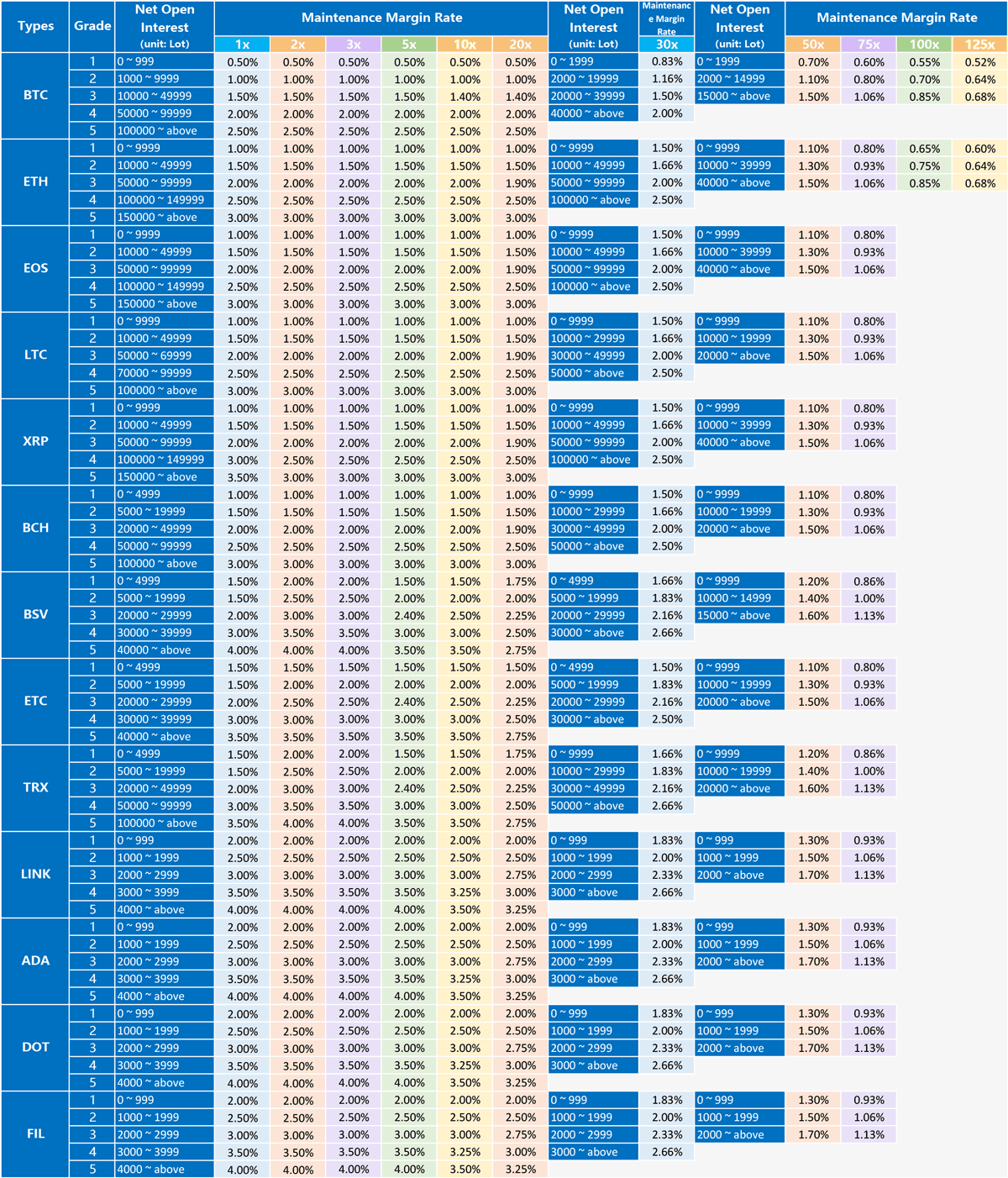

Maintenance Margin Rate = Adjustment Factor / Leverage(This data is for reference only and is not used as a basis for liquidation)

【The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.】

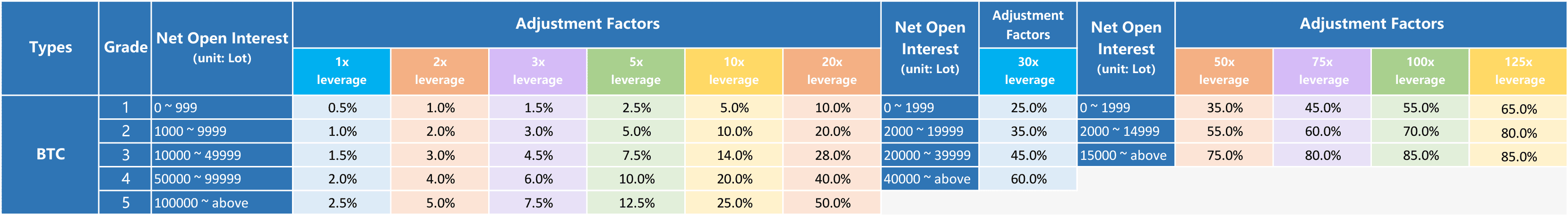

Taking BTC contract as an example, the BTC adjustment factors tiers are laid out as below:

① If a user chooses 10x leverage ratio:

With long positions of 1200 lots and short positions of 2000 lots of BTC weekly contracts;

The net position should be 800 lots ( 1 BTC contract = 100 usd/lot ) ;

Corresponds to adjustment factor of 5%.

② If a user chooses 20x leverage ratio:

Hold long positions of 1000 lots and short positions of 4000 lots of BTC weekly contracts; long positions of 8000 lots and short positions of 5000 lots of BTC biweekly contracts; long positions of 5000 lots and short positions of 0 lots of BTC quarterly contracts; long positions of 3000 lots and short positions of 3000 lots of BTC biquarterly contracts;

The corresponding net position should be: 11000 lots = 3000 + 3000 + 5000 + 0

Weekly contracts of 3000 lots = ∣ 1000 - 4000 ∣

Biweekly contracts of 3000 lots = ∣ 8000 - 5000 ∣

Quarterly contracts of 5000 lots = ∣ 5000 - 0 ∣

Biquarterly contracts of 0 lots = ∣ 3000 - 3000 ∣

* ( 1 BTC contract = 100 usd/lot ) ;

Corresponds to adjustment factor of 28%.

Join in us

WeChat:dm19518

QQ Group:770361037

Telegram:https://t.me/huobidmofficial

Huobi Futures Official Media Authenticator please click here>>>

Comments

0 comments

Article is closed for comments.